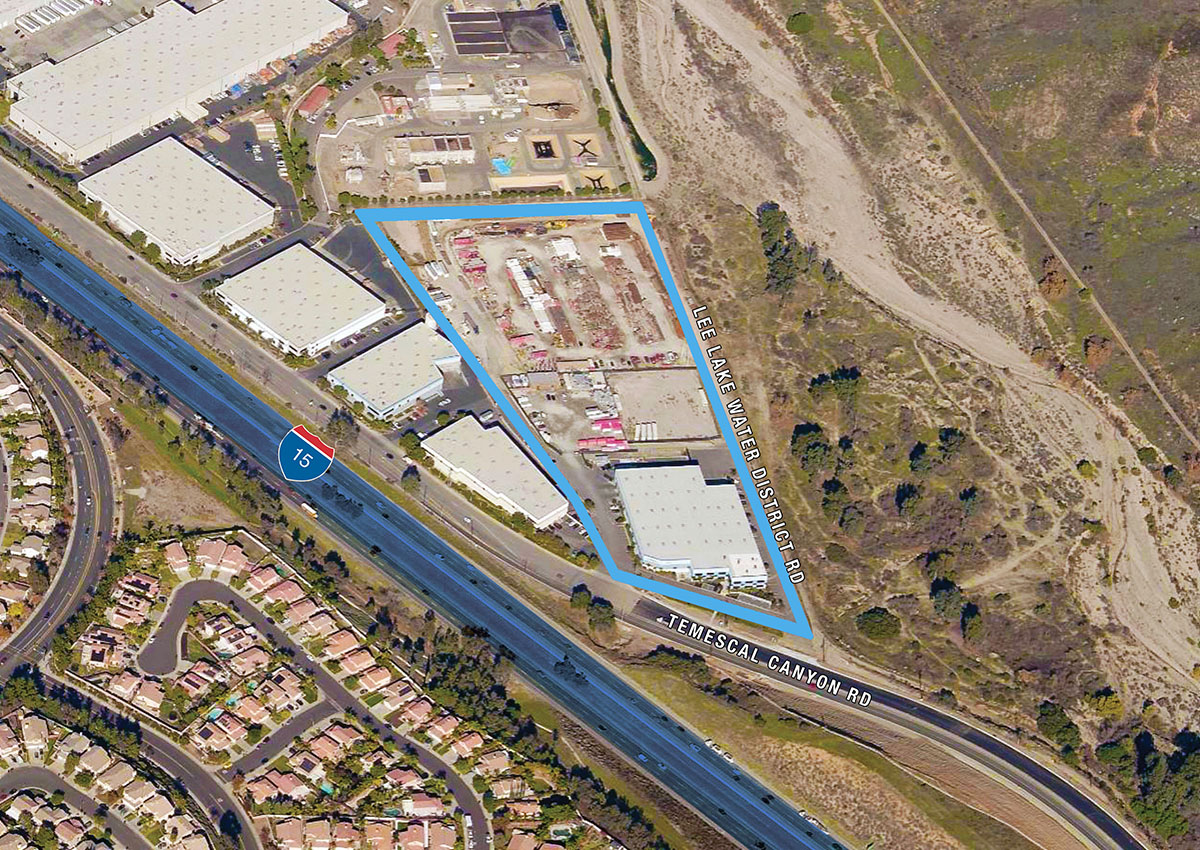

Newport Beach, CA-based North Palisade Partners, an industrial investment and development firm with assets across Southern California acquired a 13-acre property in Corona, CA. The $35 million off-market acquisition encompasses an existing industrial building along with nine acres of land slated for development of a new 205,000-square-foot Class A industrial facility. Located at 22740 Temescal Canyon Rd., the property includes a 66,984-square-foot industrial building occupied by Laticrete International.

North Palisade Partners’ Joe Mishurda, Managing Partner, said, “Acquiring an asset in this key industrial market in Southern California represents an opportunity to incorporate another value-add property into our growing West Coast portfolio. The fact that this off-market acquisition also includes a development opportunity geared to meet e-commerce distribution and logistics needs presented a unique opportunity to strengthen our holdings.”

The Corona, CA asset was acquired from an undisclosed family who had held the property for more than 30 years. North Palisade Partners is currently working to secure entitlements and finalize plans for the new 205,000-square-foot industrial building envisioned to commence construction in early 2Q 2023 on previously under-utilized land.

NAI Capital Commercial, Inc.’s Eddie Michino, Vice President, Nicholas Chang, Executive Vice President, CCIM, SIOR, Richard Lee, Executive Vice President, SIOR, along with Justin Kuehn, Vice President, and Sione Fua, Vice President, represented North Palisade Partners in the off-market deal.

Mishurda added, “The strategic location in one of the tightest industrial markets in the U.S. fits North Palisade’s long-term strategic objectives. That includes sourcing value-add opportunities like this one in the Inland Empire, unique due to the fact that the property included an existing Class A building with below market rents and excess developable land at a favorable basis which is paramount to North Palisade’s investment strategy.”

The infill development in Corona will target companies seeking modern, high clear distribution facilities in the Inland Empire including companies that play key roles in meeting the growing needs of the Inland Empire’s e-commerce sector. North Palisade Partners was attracted to this property in Corona due to the strong market fundamentals including a submarket with 0.3% vacancy, strengthening demand for Class A industrial product and little to no new supply coming online. The Corona submarket is well situated proximate to SoCal’s population base and has access to the region’s logistics corridors, given its location immediately off the 15 freeway. Additionally, the property is approximately 55 miles from the Ports of Los Angeles and Long Beach and about 20 miles to Ontario International Airport.

The deal aligns with North Palisade Partners’ strategy to acquire or develop industrial assets on well-located sites within its core markets across the West. The company’s growth plans include key logistics markets in Southern California, Northern California, Las Vegas, Reno, Seattle, Portland, and Phoenix.

North Palisade has acquired three industrial and self-storage development properties across the Southern California region for a total of $125 million in the past 45 days, with more than $500 million of additional acquisitions under contract.